2024

STORE Capital unveils a refreshed logo, designed to emphasize its focus on enduring relationships, its customer centric business model, and continued access to superior and stable capital to support customer growth.

STORE Capital unveils a refreshed logo, designed to emphasize its focus on enduring relationships, its customer centric business model, and continued access to superior and stable capital to support customer growth.

STORE Capital is acquired for ~$15 billion by GIC, a global institutional investor, in partnership with Oak Street, a Division of Blue Owl and one of the largest investors in net lease real estate.

STORE Capital’s real estate portfolio surpasses $10 billion in assets under management, spread across a growing and diverse customer base.

Co-founder Mary Fedewa named President and CEO of STORE Capital.

STORE Capital receives Business Excellence Award for the Best Middle Market Net Lease Solutions Provider in Arizona.

STORE Capital is named one of Arizona's Most Admired Companies by AZ Big Media for developing financing and lease solutions that

provide improved operational flexibility.

Mary Fedewa is named the Female Executive of the Year and presented with the Bronze Service Award by Stevie Awards.

Warren Buffett’s company, Berkshire Hathaway invests $377 million in STORE Capital, representing 9.8% of total shares outstanding.

STORE Capital Corporation is listed on the New York Stock Exchange. (NYSE:STOR).

STORE Capital introduces Master Funding Solutions®, an innovative financing concept designed to deliver tailored real estate capital solutions and operational flexibility to its customers.

STORE Capital Corporation is formed with Christopher Volk as President and CEO and co-founded by a seasoned senior management team including current President and CEO, Mary Fedewa.

Spirit Finance Corporation is sold to a private investor consortium. The shareholders make an annual rate of return of 18.5% on their investment 2004 ‐ 2007.

Spirit Finance Corporation is formed in 2003 to offer sale-leaseback capital to owners of single tenant operational real estate, and the company is taken public on the New York Stock Exchange (NYSE: SFC) in 2004.

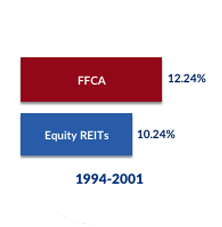

FFCA becomes the first net lease REIT to be sold to a finance company (GE Capital). FFCA shareholders make a 12.2% annual rate of return on their investment 1994-2001.

The FFCA management team completes the largest US real estate limited partnership rollup to take the combined FFCA / partnerships public on the New York Stock Exchange (NYSE: FFA).

Mort Fleischer becomes the first to introduce capital, by way of sale‐leaseback transactions, to the rapidly growing but fragmented chain restaurant industry through a series of limited partnerships sponsored by Franchise Finance Corporation of America (“FFCA”).